Enjoy a bank that fits in your pocket while meeting strict regulatory standards. N26 operates under a full German banking license, ensuring that your deposits are protected up to €100,000 by the German Deposit Protection Scheme.

N26 serves more than eight million customers across 24 markets worldwide, offering secure, app-based banking that eliminates the need for branch visits and paperwork. Read our guide to learn more about the N26 credit card.

Availability Across 23 Markets

Knowing where an account can be opened helps you plan efficiently.

N26 currently welcomes residents in:

- Austria,

- Belgium,

- Denmark,

- Estonia,

- Finland,

- France,

- Germany,

- Greece,

- Iceland,

- Ireland,

- Italy,

- Latvia,

- Liechtenstein,

- Lithuania,

- Luxembourg,

- Netherlands,

- Norway, Poland,

- Portugal,

- Slovakia,

- Slovenia,

- Spain,

- Sweden and,

- Switzerland.

Services and pricing may vary by country, yet every customer receives the same core security protections and app experience.

Debit Cards, Not Traditional Credit Cards

Clarity around card types prevents surprises later. N26 issues Mastercard debit cards linked to your current account rather than revolving-credit cards.

Purchases settle directly from available funds, so interest charges never accrue on day-to-day spending.

When temporary financing becomes necessary, two separate products—N26 Credit and N26 Overdraft—provide structured borrowing through the same app interface.

Applying for N26 Credit or Overdraft

A straightforward process keeps borrowing stress-free. Complete these steps entirely within the app:

- Download and Sign Up – Install the N26 app, choose the Standard, You, or Metal plan, and complete identity verification.

- Navigate to “Credit” – Open the Credit or Loans tab to view personalized offers generated from recent transaction data.

- Compare Offers – Evaluate loan amounts, terms, and effective interest rates displayed transparently before commitment.

- Select and Accept – Choose the most suitable loan or overdraft limit, agree to the terms, and receive funds instantly.

Approval depends on account activity from the previous 90 days. Regular incoming payments and responsible spending increase the likelihood of favorable rates and higher limits.

Key Features and Rates of N26 Credit & Overdraft

A concise overview of borrowing terms lets you gauge affordability quickly:

- Effective Interest Rates – Personal loans start at 4.06 percent p.a., with exact pricing tailored to your profile.

- Flexible Durations – Choose repayment periods that align with your cash-flow needs, minimizing pressure on your monthly budget.

- Instant Payout – Approved funds are available in seconds for transfers or card purchases.

- Overdraft Buffer – A revolving line of credit automatically cushions unexpected expenses, charging interest only on the portion used.

- App-Based Management – Track remaining balances, schedule additional repayments, and settle early without penalty.

Everyday Benefits of the N26 Mastercard Debit Card

Quick access to major card features assists decision-making. After opening any N26 account, you receive a physical or virtual debit card that delivers:

- Worldwide Acceptance – Pay at millions of merchants and withdraw cash at ATMs across the globe.

- No Foreign Transaction Fees – Spend in any currency at the market exchange rate without hidden markups.

- Real-Time Alerts – Instant push notifications confirm every card swipe, online payment, or withdrawal.

- Fee-Free ATM Withdrawals – Enjoy cost-free cash in multiple currencies under the You and Metal plans.

- Budget Tools – Categorized spend insights help you monitor outflows and optimize saving goals.

- Travel Insurance – Premium tiers bundle medical, trip delay, and baggage coverage to reduce holiday risk.

Security Toolkit Built Into Every Account

Understanding how funds stay safe strengthens trust. N26 combines multilayer protection with hands-on controls:

- 3-D Secure – Mastercard SecureCode authenticates online purchases via dynamic verification, blocking unauthorized use.

- Contactless NFC – Tap-to-pay speeds checkout while retaining chip-and-PIN safeguards for higher amounts.

- Card Controls – Lock or unlock cards, change PINs, and set spending limits inside the app anytime, anywhere.

- Push Notifications – Continuous account monitoring ensures that suspicious activity is never overlooked.

- Deposit Guarantee – Up to €100,000 per customer remains covered by German regulation regardless of market conditions.

Design Choices and Upgrade Paths

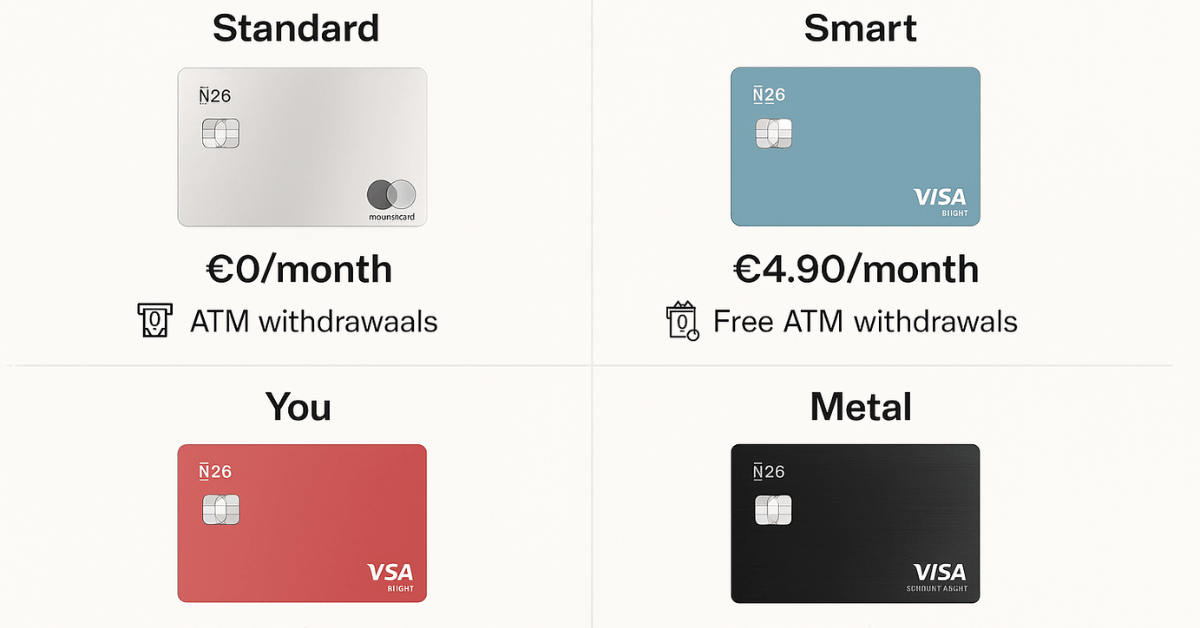

Personalizing a card’s appearance can enhance daily satisfaction. N26 offers several tiers:

- Standard Plan – Receive a free virtual card and order a transparent physical card for a €10 delivery fee.

- Smart Plan – Choose among Ocean, Sand, Rhubarb, Aqua, or Slate physical cards.

- You Plan – Access the same five colors, plus global insurance and multiple free ATM withdrawals.

- Metal Plan – Carry an 18-gram stainless-steel card in Charcoal Black, Slate Gray, or Quartz Rose, along with the highest savings rates and extended partner perks.

Premium Account Extras

Upgrading unlocks features that streamline money management. Notable advantages include:

- Spaces Sub-Accounts – Segregate budgets or savings goals in separate wallets without opening new accounts.

- Shared Spaces – Collaborate on expenses with friends, household members, or business partners.

- Partner Discounts – Redeem exclusive deals on travel, software,e and lifestyle brands.

- Enhanced Savings Rates – Metal customers currently earn up to 1.75 percent p.a. on Instant Savings balances (subject to change).

- Priority Support – Premium chat and phone lines reduce wait times if assistance becomes necessary.

Rates, Fees & Cost Transparency

Clear cost structures prevent unwelcome charges. N26 communicates pricing upfront and rarely surprises customers with hidden extras.

| Feature | Standard | Smart | You | Metal |

| Monthly Fee | €0 | €4.90 | €9.90 | €16.90 |

| Virtual Card | Included | Included | Included | Included |

| Physical Card | €10 delivery | Included | Included | Included |

| ATM Withdrawals Worldwide | €1.70 each | 5 free EU monthly | Unlimited EU + 5 worldwide | Unlimited worldwide |

| Foreign Transaction Fee | 0 % | 0 % | 0 % | 0 % |

| Instant Savings Rate* | 0.55 % | 0.55 % | 0.75 % | 1.75 % |

*Rates valid from 23 April 2025 and may change over time.

Loan and overdraft interest rates vary individually. Always review the effective annual percentage rate (APR) in the app before accepting to compare it with other lenders.

Switching From Your Current Bank

Migrating recurring payments should not be complicated. N26 partners with automated switching services that reroute direct debits and salary deposits.

Most transfers complete in minutes, allowing you to test the app alongside an existing account before moving everything.

Choosing the Right N26 Plan

Aligning features with financial habits maximizes value. Frequent travelers benefit most from You or Metal, thanks to zero-fee foreign spending, insurance, and elevated savings returns.

Domestic spenders satisfied with a virtual card may find Standard sufficient. Consider the monthly fee alongside potential ATM savings, partner offers, and insurance premiums you might pay elsewhere.

Conclusion

Balancing cost, speed, and security becomes simple when an account offers full control from a smartphone.

N26 delivers a globally accepted Mastercard debit card, transparent personal loans, and competitive savings rates, all protected by German regulation.

Apply in minutes, customize your card design, and manage every euro—worldwide—without hidden fees or cumbersome paperwork.