The Life Credit Card is designed for everyday use, offering convenience, flexibility, and simple rewards.

If you’re ready to apply, the entire process can be done online in just a few steps.

This guide will walk you through exactly what you need to do from start to finish.

Quick Check: Are You Eligible?

Before you apply, make sure you meet the basic requirements. Here’s a quick list to confirm if you qualify for the Life Credit Card:

- Age: You must be at least 18 years old.

- Residency: You should be a citizen or legal resident with valid documentation.

- Income: A regular source of income is required — full-time, part-time, or self-employed.

- Credit History: No recent defaults or significant negative marks on your credit report.

- Contact Info: A valid mobile number and email address are mandatory.

- Bank Account: You must have an active account for payments and verification.

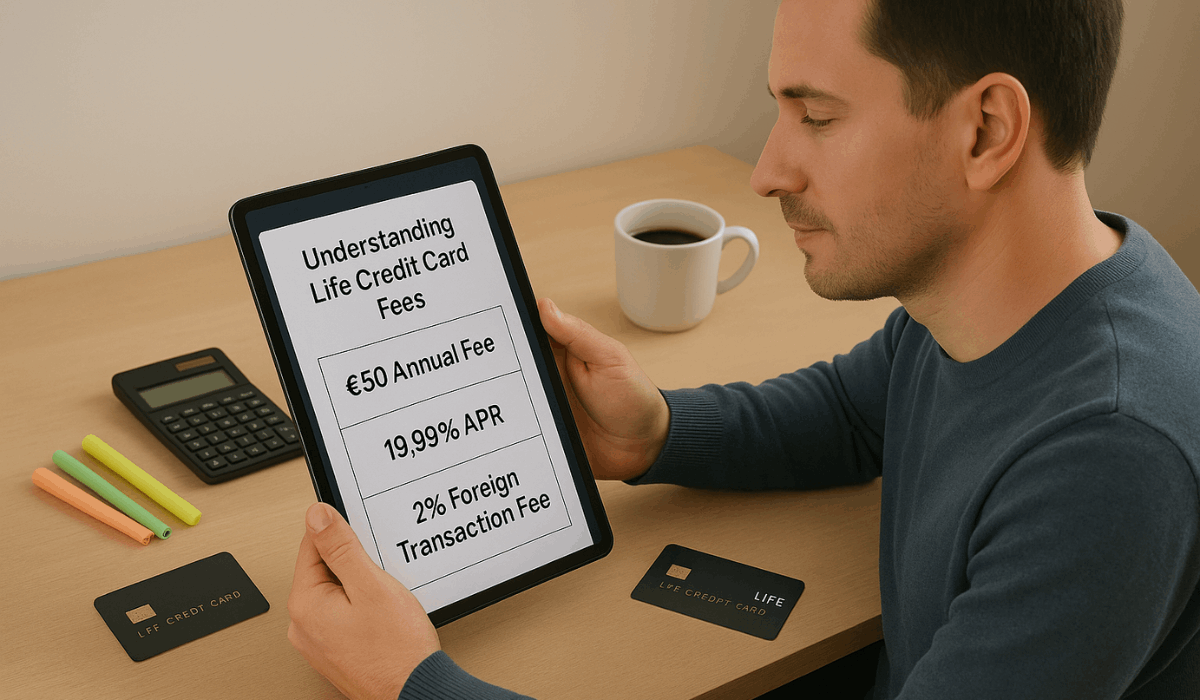

Rates, Fees, and the Fine Print (Simplified)

Understanding the costs upfront helps you avoid surprises later. Here’s a simplified breakdown of what you might pay with this card:

- Purchase APR: Around 19.99% variable, depending on your creditworthiness.

- Cash Advance APR: Usually higher, often around 24.99% or more.

- Annual Fee: Some versions incur no fee, while others may charge up to €50.

- Late Payment Fee: Typically €15–€30 if payment is not made by the due date.

- Foreign Transaction Fee: About 2%–3% of the transaction amount is charged.

- Overlimit Fee: This may apply if you exceed your credit limit — usually €20 or less.

- Grace Period: Up to 45 days if you pay your balance in full each month.

Application Walkthrough

Applying for the Life Credit Card online is fast and straightforward. Just follow these steps to complete the process from start to finish:

- Visit the Official Website: Go to the Life Credit Card application page. Make sure it’s a verified site to avoid scams.

- Click “Apply Now”: Look for the application button on the homepage or product page.

- Enter Your Info: Fill in your name, address, phone number, and email. Make sure everything matches your official documents.

- Add Employment and Income Details: Provide your job status, monthly income, and employer name (if applicable).

- Upload ID for Verification: Submit a valid government-issued ID. You may also be asked to complete video or biometric verification.

- Review and Submit: Double-check all details, agree to the terms, and click submit. You’ll receive a confirmation message or email.

- Wait for Approval: Some applications are approved instantly; others may take 1–3 business days.

After You Apply: What’s Next?

Once you hit “submit,” the process doesn’t just stop there. Here’s what typically happens next, so you know exactly what to expect:

- Confirmation Notification: You’ll get an email or SMS confirming that your application was received.

- Application Review: The bank will assess your credit history, income, and submitted details.

- Additional Requests (If Needed): You may be asked to upload extra documents or clarify information.

- Approval Timeframe: Instant approval is possible, but it usually takes 1–3 business days.

- Card Delivery: If approved, your card is mailed to your address. Delivery takes about 5–10 business days, depending on your location.

- PIN and Activation Instructions: These are usually sent separately by SMS, email, or post. Follow the steps to securely activate your card.

- Start Using Your Card: Once activated, you can immediately use your Life Credit Card for online and in-store purchases.

First Things to Do When You Get the Card

Getting approved is just the beginning. Here’s what you should do right after your card arrives:

- Check the Envelope Contents: Make sure your name is correct and that you received both the card and any activation instructions.

- Activate the Card: Use the method provided — usually via SMS, online portal, or phone call.

- Set Your PIN: If a PIN wasn’t offered, follow the instructions to create one for ATM or chip transactions.

- Register for Online Banking: Sign up for account access through the website or mobile app to monitor spending and manage payments.

- Add to Mobile Wallet (Optional): Link the card to Apple Pay, Google Pay, or other digital wallets for contactless payments.

- Make a Small Test Purchase: Use the card for a minor transaction to confirm it’s active and working correctly.

- Review the Welcome Kit: Read through any included materials to understand rewards, fees, and due dates.

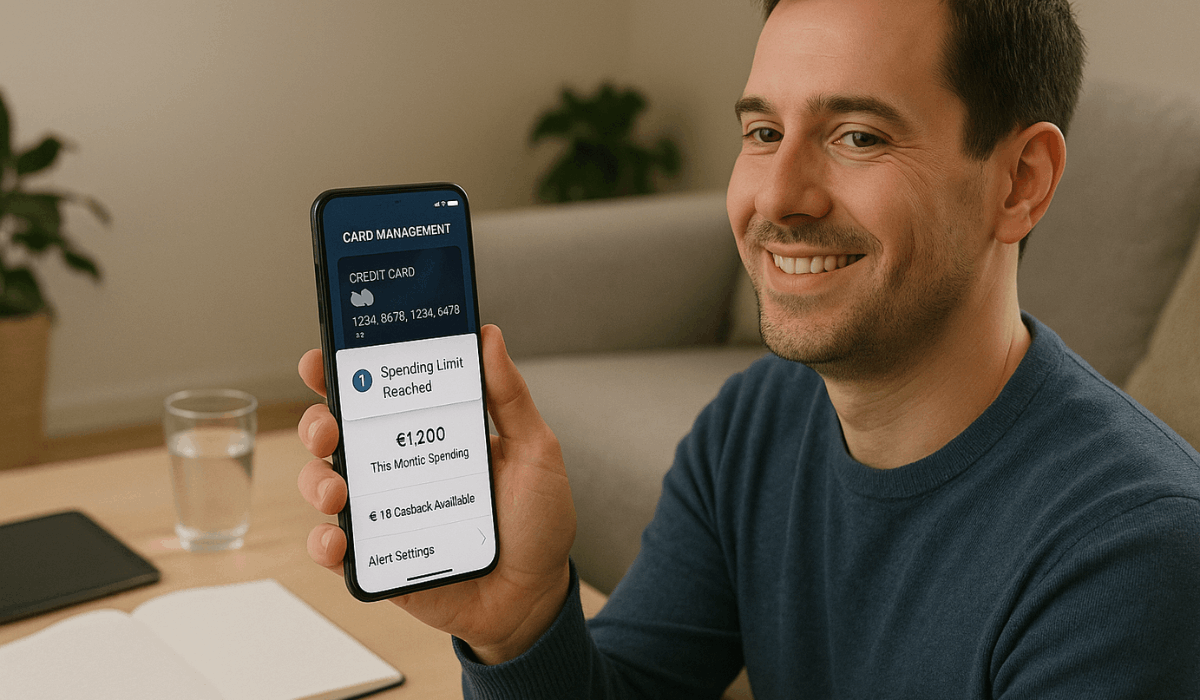

How to Stay on Top of Your Card

Managing your card responsibly can help you avoid fees, build good credit, and maximize its features.

Here are practical steps to keep everything under control:

- Log In Often: Check your balance and transactions using the mobile app or online account.

- Set Payment Reminders: Use alerts or calendar reminders to avoid missing due dates.

- Enable Notifications: Turn on SMS or app alerts for spending activity, payments, or low balance warnings.

- Pay More Than the Minimum: Pay your full balance to avoid interest charges.

- Track Your Spending: Stick to a monthly budget and monitor how much you’re charging to your card.

- Watch Your Credit Limit: Keep usage below 30% of your limit to maintain a healthy credit score.

- Review monthly statements carefully, looking for errors or unauthorized charges, and report them immediately.

FAQ You’ll Care About

Here are the questions that most people genuinely want answered, including some that haven’t been covered yet in this guide:

- Can I apply without a job? Yes, but you must demonstrate a steady income, such as freelance work, a pension, or part-time gigs. Passive income may count too.

- Is a co-signer allowed?: No. Applications must be done individually. Joint or co-signed requests aren’t accepted.

- Can I request a credit limit increase later?: Yes. After a few months of good use, you can order it via the app or customer service.

- Is a balance transfer available?: Some card versions allow it. If so, you may qualify for a lower introductory rate — check your terms.

- Can I manage my card entirely from the app?: Yes. You can track spending, pay bills, update details, and lock the card from the app.

- Does Life Credit Card offer contactless payments?: Yes. Most cards support tap-to-pay and work with Apple Pay or Google Pay.

- What happens if my application is denied?: You’ll get an email with the reason. You can reapply after fixing the issue or waiting 3–6 months.

- Can foreign residents in Japan apply?: Yes, if you have a valid residence permit with at least 24 months left.

When to Contact Support (and What to Expect)

If you run into any issues or have questions about your application, here’s how you can get in touch with the Life Card team:

- Phone Support: Call 045-914-7003

- Available Monday to Friday, 10:00 AM to 5:00 PM. (Support is closed on weekends and public holidays.)

- Mailing Address:

- Life Card Co., Ltd.

- 2-2-17 Takashima, Nishi-ku, Yokohama, Kanagawa 220-0011, Japan

Wrap-Up: Ready to Apply? Here’s Your Next Step

The Life Credit Card is easy to apply for and built for everyday use.

Now that you know the steps, you’re ready to start your application with confidence.

Head to the official site and apply online today to take control of your spending.

Disclaimer

Details here may change based on the issuer’s latest updates or promotions.

Before applying, check the official Life Credit Card website for the most accurate and current information.